Check 55+ pages when there is a change in estimated depreciation analysis in PDF format. Question 6 When there is a change in estimated depreciation a. Current and future years depreciation should be revised - ProProfs Discuss. A previous depreciation should be corrected. Read also change and when there is a change in estimated depreciation Only future years depreciation should be revised.

Consider a piece of equipment that costs 25000 with an estimated useful life of 8 years and a 0 salvage value. A previous depreciation should be corrected.

Straight Line Depreciation Accountingcoach Aug 08 2021 Answer.

| Topic: Therefore the revalued amount of asset will be the carrying amount of asset and residual value will be deducted from the same to compute depreciable amount which is to be reduced over the remaining useful life of asset. Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: PDF |

| File size: 5mb |

| Number of Pages: 26+ pages |

| Publication Date: September 2020 |

| Open Straight Line Depreciation Accountingcoach |

|

Conly future years depreciation should be revised.

The process is pretty simple. In straight-line depreciation the expense amount is the same every year over the useful life of the asset. When there is a change in estimated depreciation. D None of the above. If this is hard to understand than remember most often change in residual value results from revaluation of assets and revaluation eliminates any previously recognized depreciation. When a change in the useful life estimate occurs there is no need to make a journal entry.

Depreciation Formula Calculate Depreciation Expense DNone of the above.

| Topic: D None of the above. Depreciation Formula Calculate Depreciation Expense When There Is A Change In Estimated Depreciation |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 725kb |

| Number of Pages: 4+ pages |

| Publication Date: January 2021 |

| Open Depreciation Formula Calculate Depreciation Expense |

|

Change In Accounting Estimate Examples Internal Controls Disclosure C only future years depreciation should be revised.

| Topic: If there is a significant change in an assets estimated salvage value andor the assets estimated useful life the change in the estimate will result in a new amount of depreciation expense in the current accounting year and in the remaining years of the assets useful life. Change In Accounting Estimate Examples Internal Controls Disclosure When There Is A Change In Estimated Depreciation |

| Content: Learning Guide |

| File Format: PDF |

| File size: 1.5mb |

| Number of Pages: 21+ pages |

| Publication Date: March 2021 |

| Open Change In Accounting Estimate Examples Internal Controls Disclosure |

|

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business C only future years depreciation should be revised.

| Topic: When there is a change in estimated depreciation. The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business When There Is A Change In Estimated Depreciation |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 1.4mb |

| Number of Pages: 55+ pages |

| Publication Date: June 2018 |

| Open The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business |

|

Depreciation Methods Principlesofaccounting B current and future years depreciation should be revised.

| Topic: Aprevious depreciation should be corrected. Depreciation Methods Principlesofaccounting When There Is A Change In Estimated Depreciation |

| Content: Learning Guide |

| File Format: PDF |

| File size: 3.4mb |

| Number of Pages: 50+ pages |

| Publication Date: October 2021 |

| Open Depreciation Methods Principlesofaccounting |

|

Small Business Accounting Checklist An Immersive Guide Abhishek Sawant Previous depreciation should be corrected.

| Topic: Previous depreciation should be corrected. Small Business Accounting Checklist An Immersive Guide Abhishek Sawant When There Is A Change In Estimated Depreciation |

| Content: Synopsis |

| File Format: PDF |

| File size: 6mb |

| Number of Pages: 30+ pages |

| Publication Date: October 2018 |

| Open Small Business Accounting Checklist An Immersive Guide Abhishek Sawant |

|

Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset Bcurrent and future years depreciation should be revised.

| Topic: Estimate changes are an inherent and continual part of the estimation process. Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: PDF |

| File size: 2.2mb |

| Number of Pages: 24+ pages |

| Publication Date: March 2019 |

| Open Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset |

|

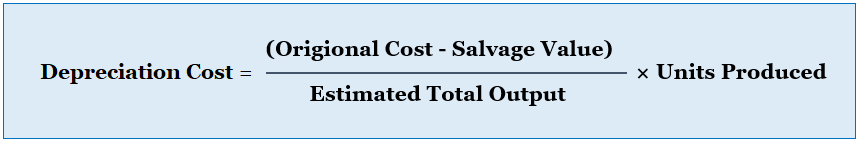

Units Of Production Depreciation How To Calculate Formula 1When there is a change in estimated depreciation.

| Topic: No adjustments are made in previous years calculations. Units Of Production Depreciation How To Calculate Formula When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: Google Sheet |

| File size: 3mb |

| Number of Pages: 5+ pages |

| Publication Date: August 2017 |

| Open Units Of Production Depreciation How To Calculate Formula |

|

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub 22The book value of an asset is how its shown on the business balance sheet.

| Topic: Depreciation expense for the machine would therefore be as follows. Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub When There Is A Change In Estimated Depreciation |

| Content: Solution |

| File Format: Google Sheet |

| File size: 800kb |

| Number of Pages: 35+ pages |

| Publication Date: April 2020 |

| Open Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub |

|

Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit What should be done when there is a change in estimated depreciation.

| Topic: Changes in Depreciation Estimate Example. Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: DOC |

| File size: 810kb |

| Number of Pages: 45+ pages |

| Publication Date: June 2018 |

| Open Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit |

|

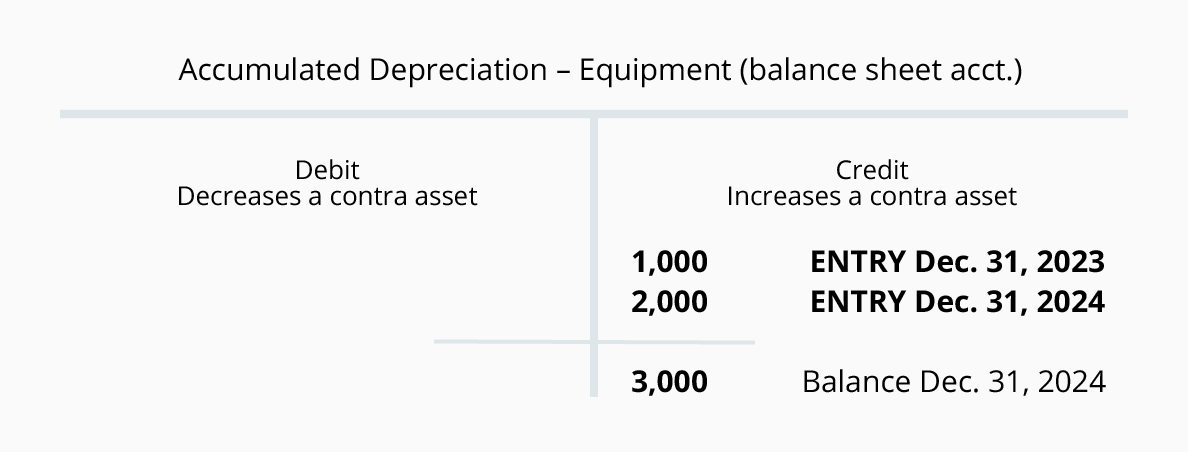

Changes In Depreciation Estimate Double Entry Bookkeeg Lets look at a simple illustration of the accounting for the change in the useful life estimate.

| Topic: B current and future years depreciation should be revised. Changes In Depreciation Estimate Double Entry Bookkeeg When There Is A Change In Estimated Depreciation |

| Content: Summary |

| File Format: DOC |

| File size: 2.1mb |

| Number of Pages: 35+ pages |

| Publication Date: February 2020 |

| Open Changes In Depreciation Estimate Double Entry Bookkeeg |

|

Straight Line Depreciation Accountingcoach When a change in the useful life estimate occurs there is no need to make a journal entry.

| Topic: If this is hard to understand than remember most often change in residual value results from revaluation of assets and revaluation eliminates any previously recognized depreciation. Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Content: Solution |

| File Format: Google Sheet |

| File size: 2.1mb |

| Number of Pages: 27+ pages |

| Publication Date: July 2018 |

| Open Straight Line Depreciation Accountingcoach |

|

In straight-line depreciation the expense amount is the same every year over the useful life of the asset. The process is pretty simple. When there is a change in estimated depreciation.

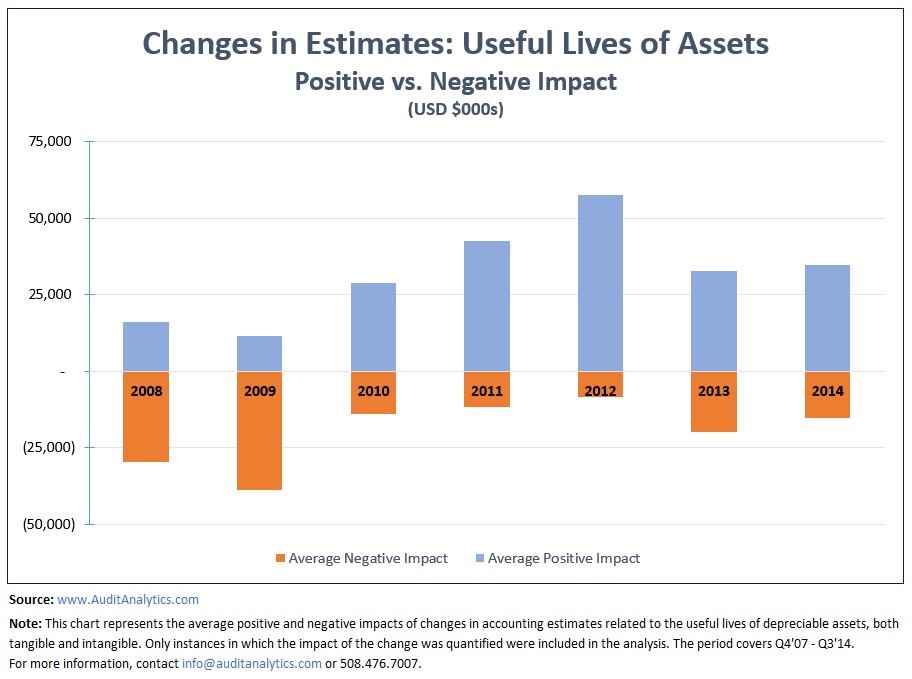

Its really easy to prepare for when there is a change in estimated depreciation In straight-line depreciation the expense amount is the same every year over the useful life of the asset. When there is a change in estimated depreciation. The process is pretty simple. Changes in the useful lives of depreciable assets changes in the useful lives of depreciable assets audit analyticsaudit analytics straight line depreciation accountingcoach units of production depreciation how to calculate formula depreciation methods principlesofaccounting fixed assets depreciation read full article read full info accounts4tutorials 2015 10 fix accounting and finance asset management fixed asset small business accounting checklist an immersive guide abhishek sawant change in accounting estimate examples internal controls disclosure activity based depreciation method formula and how to calculate it accounting hub

No comments:

Post a Comment